what is suta tax rate for california

New Hampshire has raised its unemployment tax rates for the second quarter of 2020. Most states send.

Suta Tax Your Questions Answered Bench Accounting

The SUI taxable wage base for 2020 remains at 7000 per employee.

. The new employer SUI tax rate remains at 34 for 2021. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. 4 rows Imagine you own a California business thats been operating for 25 years.

Stay up-to-date with your SUTA wage base to ensure youre withholding the correct amount of SUTA tax for each employee. 065 68 including employment security assessment of. As a result of the ratio of the California UI Trust Fund and the total wages paid by all.

Like SUTA wage bases SUTA rates also. Tax rates for the second quarter range from 01 to 17 for positive-rated employers. For example if you own a non-construction business in California in.

State unemployment tax rates. The amount of the tax is based on the employees wages and the states unemployment rate. 52 rows You may receive an updated SUTA tax rate within one year or a few years.

Below is a chart with the. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. In the State Tax Information information find your SUI rate.

The withholding rate is based on the employees Form W-4 or DE 4. Review the PIT withholding schedule. The maximum FUTA tax an employer must pay per employee per.

What is the SUTA rate for 2021. Each state has its own limit for the wage base subject to SUTA taxes. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

According to the EDD the 2021 California employer SUI tax rates. Once the low rate is achieved large payroll amounts from another related corporation are transferred into this account. State SUTA new employer tax rate Employer tax rate range SUTA wage bases Alabama.

The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. Employers report their tax liability annually on IRS Form 940 but quarterly tax deposits may be required. State unemployment tax is a percentage of an employees.

To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. There is no taxable wage limit. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base.

There is no maximum tax. What is the current SUTA rate for 2020. 2 days agoSince federal income tax rates go up to 37 and the winner is in the top 37 bracket another 131297 million more in taxesis due on April 15.

For example the wage base limit in California is 7000. Effective January 1 2022. The SUI taxable wage base for 2021 remains at 7000 per employee.

New Employer Rate An employer with a high UI rate files a.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Outlook For Sui Tax Rates In 2023 And Beyond

How Do State And Local Individual Income Taxes Work Tax Policy Center

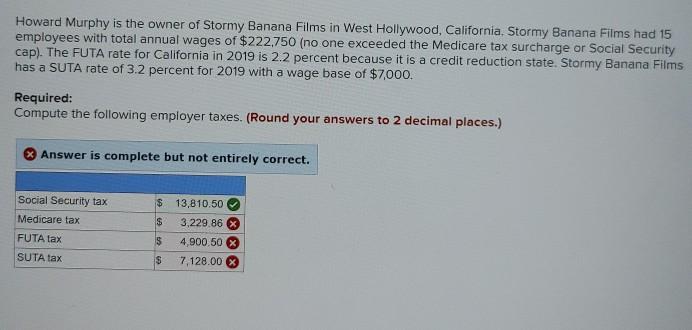

Howard Murphy Is The Owner Of Stormy Banana Films In Chegg Com

What Is Futa Tax 2021 Tax Rates And Information

What Is Your State S Unemployment Tax Rate Ballotpedia News

The Income Gap Unemployment And Tax Rates Visual Ly

How Much Does An Employee Cost In California Gusto

2022 Federal State Payroll Tax Rates For Employers

Update Ui Ett Rates California Employer Candus Kampfer

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Futa Rate Increases For California Infographic

California Tax Rates Rankings California State Taxes Tax Foundation

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

State Unemployment Tax Suta How To Calculate And Pay It

California 2012 Withholding Tables Ca 2012 Sdi Rate Ca 2012 Ui Rate Ca 2012 Ett Rate Real Business Solution Blog

What Is The Futa Tax 2022 Tax Rates And Info Onpay

California Tax Agencies New Company Registration And Information