nebraska sales tax rate

With local taxes the. The Nebraska state sales and use tax rate is 55.

Taxes And Spending In Nebraska

The Total Rate column has an for those municipalities.

. The Omaha sales tax rate is. 536 rows Nebraska Sales Tax55. 800-742-7474 NE and IA.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed. Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts.

See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. The County sales tax rate is. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state.

The Lincoln sales tax rate is 175. What is the sales tax rate in Lincoln Nebraska. The Nebraska sales tax rate is currently.

Sales Tax Rate Finder. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax.

Ad Find Out Sales Tax Rates For Free. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. The Ord Sales Tax is collected by the merchant on all qualifying sales made within Ord.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. This is the total of state county and city sales tax rates.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. The minimum combined 2022 sales tax rate for Omaha Nebraska is. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax.

What is the sales tax rate in Omaha Nebraska. Ord collects a 15 local sales tax the maximum local. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75.

Nebraska Department of Revenue. Waste Reduction and Recycling Fee. Groceries are exempt from the Ord and Nebraska state sales taxes.

Did South Dakota v. NE Sales Tax Calculator. Sales and Use Taxes.

Nebraska has collected 5153 billion in the current fiscal year that ends on June 30. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. Average Sales Tax With Local.

Wayfair Inc affect Nebraska. The Nebraska NE state sales tax rate is currently 55. 31 rows The state sales tax rate in Nebraska is 5500.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. Are there county as well as city sales and use taxes in Nebraska. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

This is the total of state county and city sales tax rates. Groceries are exempt from the Nebraska sales tax. The Nebraska state sales and use tax rate is 55 055.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725. Did South Dakota v. The Nebraska sales tax rate is currently 55.

This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55. Fast Easy Tax Solutions. Printable PDF Nebraska Sales Tax Datasheet.

FilePay Your Return. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0825 for a total of 6325. Thats 111 above the official forecast of 4637 billion.

The County sales tax rate is 0. Nebraska sales tax details. The Nebraska State Sales Tax is collected by the merchant on all qualifying sales made within.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected.

Taxes And Spending In Nebraska

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

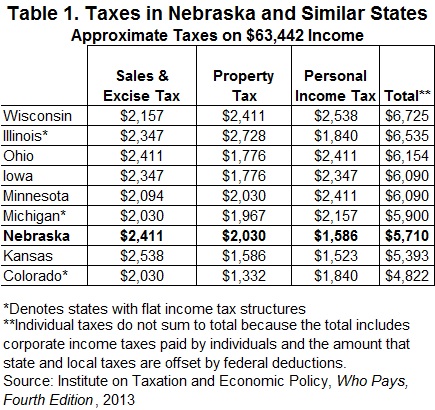

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Taxes And Spending In Nebraska

New Ag Census Shows Disparities In Property Taxes By State

General Fund Receipts Nebraska Department Of Revenue

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Nebraska Drops To 35th In National Tax Ranking

Nebraska Sales Tax Rates By City County 2022

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Nebraska Sales Tax Small Business Guide Truic

What Is The Gas Tax Rate Per Gallon In Your State Itep

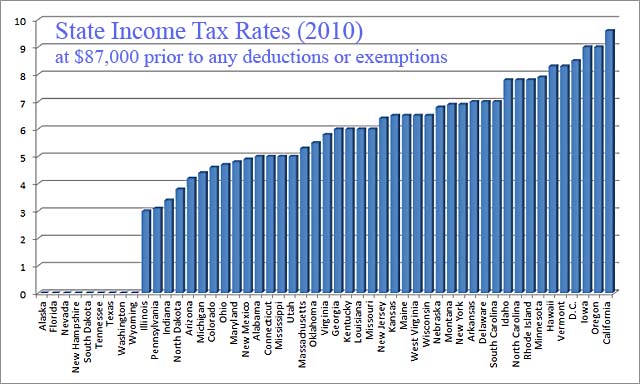

Compared To Rivals Nebraska Takes More From Taxpayers